Can You Collect Social Security At 66 And Still Work Full Time?

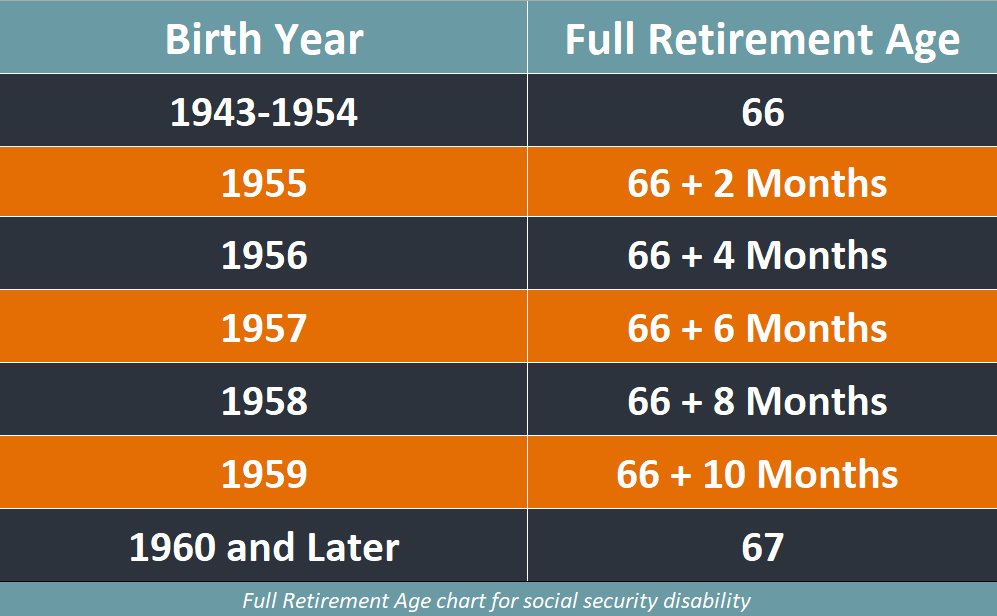

When a person reaches their full retirement age (FRA), they can earn an unlimited amount of income and still receive the full amount of their retirement benefits. If you were born between 1943 and 1954, then your full retirement age (FRA) is 66. But that is not the FRA for everyone.

If you take your Social Security retirement benefits before you reach your FRA, then you may be limited in how much income you can earn without affecting the amount of your benefits.

What Is Your Full Retirement Age?

Until 1983, the full retirement age for every American was 65 years old. Because of concerns that the Social Security System would become insolvent in the future without raising the age at which people could begin to receive Social Security retirement benefits, Congress changed the law.

The new law provided for a gradual increase in the age at which future retirees could claim Social Security benefits. Instead of everyone qualifying for full Social Security retirement benefits at age 65, the new plan raised the retirement age by 2 months for each successive year in which someone was born. The only exception was for people born between 1943 and 1954; all people born in those years were eligible to at age 66.

Beginning in 1955, two months were added to the FRA every year until 1960, when those born that year and after will have their FRA set at 67.

To find out what your Full Retirement Age is, check the year you were born on this chart:

Claiming Social Security Retirement Early (Before Full Retirement Age)

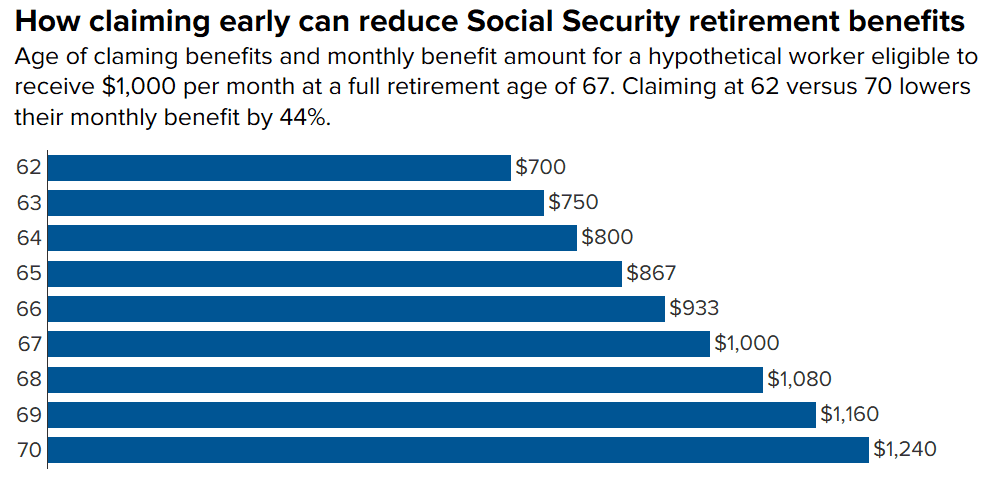

The law allows a person to claim their Social Security retirement benefits early, that is before they reach their full retirement age. You can file a claim to begin receiving your Soc. Sec. retirement benefits as early as age 62, but doing so will permanently forfeit a large portion of the amount you would receive in monthly benefits if you waited until your full retirement age to claim benefits.

To learn how the amount of your full Social Security retirement benefit amount is calculated, read the section below about “Calculating Your Social Security Benefit Amount.”

Only people who claim their Social Security retirement benefits before their full retirement age are limited as to what they may earn in other income before their early retirement benefits are reduced.

Earning Limits for Early Social Security Retirement Claimants in 2022

If a person retires earlier than at their full retirement age, as we’ve mentioned, an income limit applies that may reduce the amount of their monthly benefits. Here’s how it works.

In 2022 the maximum allowable annual income an early retirement benefit claimant can earn without affecting their benefits is $19,560. For every two dollars earned that exceed that amount, their monthly benefit payment will be docked one dollar. For example, if a person who took early retirement from Social Security earns $27,600 in 2022 by working during retirement, the income will exceed the cap by $8,040. The Social Security retirement benefit would be reduced by $4,020 (an amount equal to half the excess income).

Someone who files for early retirement benefits in the month they turn 62 may have already earned more than the annual cap by the month of their 62nd birthday. If they turn 62 in October and have already earned $60,000 during the preceding months of that year, then Social Security uses a monthly measure of income.

For example, the $19,560 annual cap works out to $1,630 per month. For the remaining months of the year in which an early retiree filed for benefits, their monthly income will determine if they earned above the allowable income limit. For every 2 dollars over $1,630 they earn in one of the remaining months, their benefit payment will be reduced by 1 dollar.

Do You Get Back the Money You Were Docked for Earning Too Much?

Yes. All of the benefit dollars that were withheld from your monthly retirement payments during the time you were retired before you reached your full retirement age are added and get paid back to you over time once you reach your FTA.

Here’s how that part of the process works.

Let’s say that someone retired at age 62.4 months when their actual full retirement age was 66 and 4 months. During those 48 months, let’s assume that Social Security withheld $12,000 from their monthly benefit payments. During each of those years they earned $6,000 more than the cap, resulting in Social Security holding back $3,000 in benefit payments. If their monthly benefit payments were supposed to be $1,200 per month, then the total withheld from their benefits over those 4 years is equal to 10 months of their normal benefits.

People who retire earlier than their full retirement age forfeit up to 30% of the amount they would have received had they waited until their FRA. For each month after their 62nd birthday they wait, their benefit amount climbs. In our example, the person retired at age 62 and 4 months when their FRA was 66 and 4 months, 48 months early.

Since they retired 48 months earlier than scheduled, their full retirement benefit amount is permanently cut by 25%. If they waited until their FRA, their monthly benefit would have been $1,600 per month. Instead, they retired 48 months early, cutting their benefit amount to $1,200 per month. But the money withheld during those earlier retirement years equals 10 months of their benefit payments.

The Social Security Administration then applies the withheld money to the retiree’s account by crediting them with 10 additional months of delayed retirement, reducing their premature retirement from 48 months to 38 months short of their FRA. By getting credit for those extra 10 months, Their FRA benefit of $1,600 is only reduced by 20.83% instead of 25%.

The result is that their permanent monthly retirement benefit amount rises from $1,200 to $1,267.

Note: As you will see in the next, the amount of your Social Security benefit amount is determined by your lifetime taxable earnings. If you do retire before your full retirement age, but then keep earning an income that is one of the highest 35 incomes you’ve ever earned, then your those earnings could boost your monthly retirement benefit when they get figured into the formula we’ll explain in the section “Calculating Your Social Security Benefit Amount.”

Why Are Early Retirees Punished with Benefit Reductions?

Every worker’s Social Security retirement benefit amount is determined by using their 35 highest years of taxable income earning. The system assumes that everyone will continue to earn and will not retire until their full retirement age. Consequently, when someone files an early retirement claim, sometimes as early as age 62, the Social Security Administration is paying out benefits long before schedule. Only by reducing the monthly benefit paid to early retirees can the system be made to balance out the early claim payouts.

Calculating Your Social Security Benefit Amount

Planning for retirement can be difficult if you don’t have the information you need to anticipate what your income will be. Since most people count on receiving Social Security retirement benefits as one part of their income, it helps to be able to know what your benefit amount will be, and how it was arrived at.

To get your specific benefit calculations, you can visit the “my Social Security” website and create an account. There you will find a listing of every year’s taxable income you reported over your entire working life.

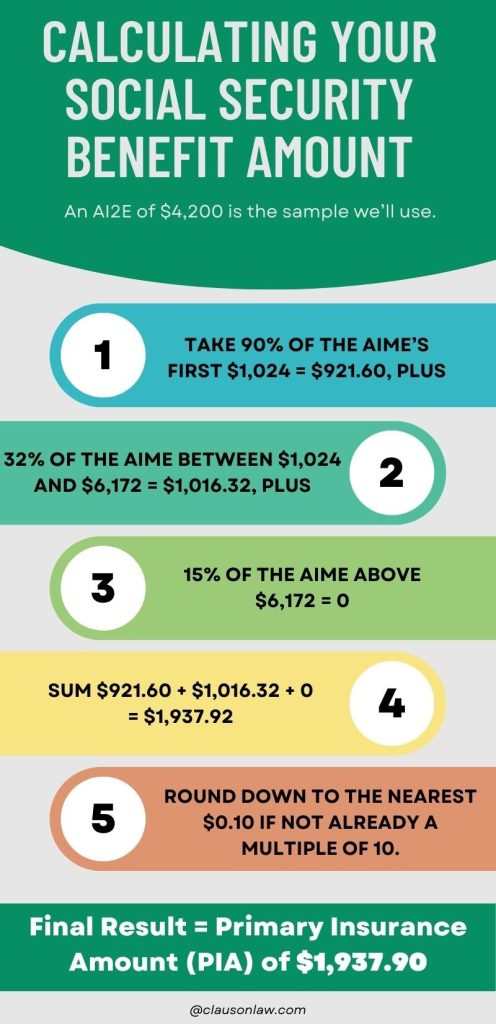

The figures kept by the IRS and the Social Security Administration are used to determine how much each person has contributed over their life, and then apply a simple formula to those figures. The result is what is called your Primary Insurance Amount (PIA). Your PIA is the amount of your monthly retirement benefit payment. It is also the amount you would receive every month if you were to file for and be approved for Social Security Disability benefits.

The Formula: The Social Security Administration finds the 35 highest earning years in your working career and adds them together. That sum is then divided by 35 to arrive at an average. But before that figure is accepted, each year’s income is indexed against the national average to track inflation and living costs.

The final annual average is then divided by twelve to produce your “Average Indexed Monthly Earnings.” (AIME). The AIME is the first figure plugged into the following formula which determines the amount of your SSD benefits and your retirement benefits.

This is the method the Social Security Administration uses to determine the amount of your Social Security retirement benefits at Full Retirement Age (FRA).

2 Comments

Look like my heath and job to qaulification to early 65 to get a close pension from fed.

my husband died due to wrongful death incident. i think. are you willing to look at it to check