Social Security Disability Benefits Pay Chart For Dependents

Whether you are in the process of applying for Social Security disability benefits or already are receiving them, you want to know how much you and your dependents can anticipate receiving each month in 2021 and 2022. Whatever you currently receive through the Supplemental Security Income or Social Security Disability Insurance programs will change as of the first of the year.

Disability benefits through Social Security are subject to change each year depending on how the economy happens to be doing. Annual cost-of-living adjustments apply to retirement benefits as well as SSD benefits payable through the SSA.

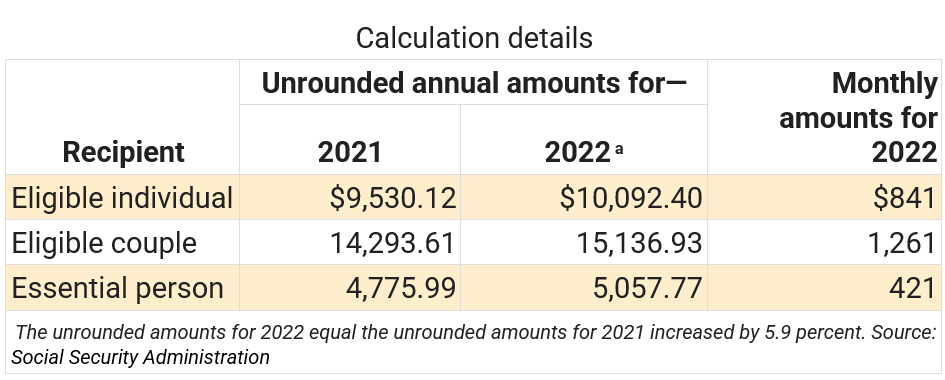

Because of the rate of inflation, the SSA announced that Social Security benefits will experience an increase of 5.9% effective for the 2022 benefit year starting in January. To help you understand how the COLA increase affects your monthly SSD benefits, the Social Security disability lawyers at the Clauson Law Firm put together the most currently available information and an SSD benefits pay chart. Use them to determine how your monthly benefit changes in 2022, but do not hesitate to contact the Clauson Law Firm for answers to any questions you may have or for help with applications and with appeals of adverse determinations.

How does Social Security calculate benefit payments for SSI?

The method used to calculate the amount that you receive in benefits each month depends on whether payments come through the SSI or SSDI program. SSI benefit payments are based on a maximum federal benefit.

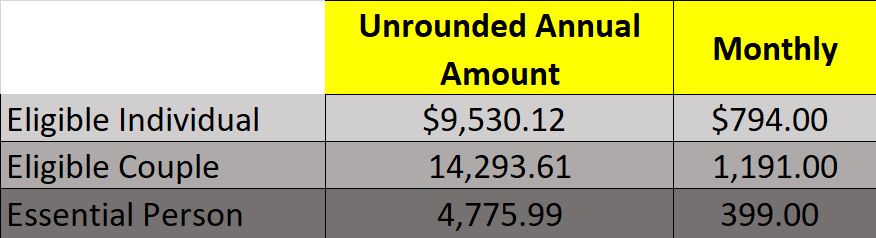

The monthly federal benefit amount for 2021 is $794 for an individual and $1,191 for a married couple. Dependents of beneficiaries of SSI benefits generally do not qualify for benefits unless they are blind or disabled with limited financial resources and income and can qualify for SSI benefits of their own. The federal benefit amount does not include payments a person receives as a supplement from their state of residence.

Although it does not pay benefits to dependents, monthly payments are available through SSI for what the SSA defines as an “essential person.” An essential person is someone residing with and providing essential care to the SSI recipient. For example, a child living with and caring for a parent who receives SSI would be eligible for monthly benefit payments as an essential person. Essential benefits cannot be paid to someone who is or becomes eligible for SSI benefits.

SSD pay chart for SSI beneficiaries

The following 2021 SSD benefits pay chart for SSI beneficiaries and essential persons is based on data from the Social Security Administration:

Use the 2022 SSD benefits pay chart shown below from Social Security to compare SSI benefits for 2021 with the new amounts for 2022 that reflect one of the largest COLA increases:

To better place the significance of the 2022 COLA adjustment in perspective, the 2021 adjustment was only 1.3%.

The payment that you actually receive each month through SSI may be less than the federal benefit amount. Social Security reduces your monthly benefit by countable income that you have for the month. Countable income includes anything you receive within a calendar month that you may use to meet your food or shelter needs.

For example, if friends allow you to stay at their home without charging you rent, the fair market value of the shelter would be treated as in-kind income and counted against your monthly benefit. Countable income also includes cash given to you either as gifts or as payment for work.

If you have income, make a point to speak with an SSD lawyer at Clauson Law because not all income counts toward decreasing your monthly SSI benefit. As an example, the first $20 of income from any source, either earned or unearned, may be excluded along with the first $65 of earned income. Only one-half of the remaining earned income that you have after deduction of the $65 counts against your monthly SSI benefit.

A blind or disabled student who is younger than 22 years of age and attending school while receiving SSI benefits may exclude earned income of up to $1,930 per month up to a yearly total of $7,770 during 2021. The monthly student exclusion increases in 2022 to $2,040 with an annual maximum of $8,230 reflecting the COLA increase of 5.9%.

In summary, what you receive from SSI may be less than the monthly federal benefit amount of $841 in 2022 depending on your countable income. For couples, monthly countable income is split equally between them and applied toward reduction of the $1,261monthly federal benefit amount paid to couples on SSI.

How does Social Security calculate SSDI benefits?

Determining what your monthly SSDI benefit should be takes more effort than figuring out what you get each month through SSI. First, keep in mind that SSI is a need-based program that does not rely on an applicant’s work history and earnings record to qualify them for benefits or to calculate the amount of their payment.

To qualify for SSDI, you must be “insured” by having earned a sufficient number of work credits. You earn work credits based on the income earned through employment or self-employment provided you paid Social Security taxes either through payroll deductions or by reporting your income from self-employment and paying the taxes on your federal tax return.

Each $1,470 that you have in covered earnings earns one work credit. You may earn up to four credits each year. The per-credit-cost increases to $1,510 in 2022. You must have 40 work credits to qualify for Social Security retirement benefits. The number needed for SSDI depends on how old you are when you become disabled.

A worker who becomes disabled at 30 may qualify for SSD through SSDI with eight work credits while a 50-year-old worker may need the equivalent of seven years of work or 28 work credits to qualify. Once you have a sufficient number of credits to qualify for benefits, neither the severity of your disability nor the total number of work credits factors into the calculation of your monthly payment through SSDI.

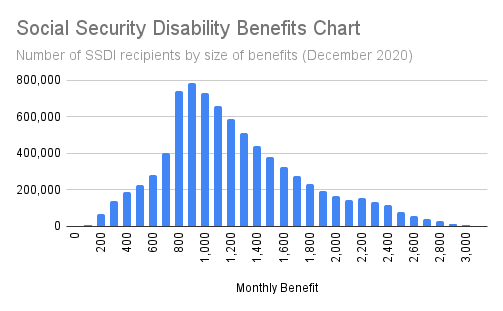

Social Security uses your average lifetime earnings working at jobs or self-employment on which you paid Social Security taxes. As a result, SSDI does not have a set monthly benefit. Instead, Social Security uses a complex calculation to determine what each worker receives. According to data compiled and released by the SSA, the average monthly payment through SSDI in 2021 is $1,277. The maximum that you can receive at full retirement age is $3,148.

Social Security disability benefits pay chart for dependents

If you receive SSDI benefits, your dependents also may be eligible as well. The following members of your family may qualify:

- Spouse

- Divorced spouse

- Children

- An adult child who was disabled before turning 22 years of age

Each eligible member of your family may receive up to 50% of the amount that you receive each month from SSDI. The exact amount an eligible dependent actually receives cannot be found in an SSD benefits pay chart for child or dependent because it is determined by the amount that the SSDI beneficiary is eligible to receive each month.

Although each dependent is eligible to receive up to 50% of your SSDI benefit, there is a cap on the total amount the SSA will pay to you and your dependents. As a general rule, the total to you and your dependents is between 150% to 180% of your SSDI benefit.

If the dependent eligible to receive benefits is your spouse, benefits may start when your spouse turns age 62. However, it may benefit your spouse to wait until full retirement age rather than collecting at 62 to avoid the reduction in the benefit amount based on the number of months until full retirement.

Generally, benefits for your dependent children end when they turn 18 years of age, but benefits may continue if the child is not married and is a full-time student in elementary or secondary school. In that case, the child may continue to receive benefits until graduating from high school or two months beyond turning age 19, whichever occurs first.

An adult child who has a disability that started before age 22 may be eligible for benefits through the Social Security record of a parent entitled to receive SSDI benefits. Since the benefits to the child are paid based on the earnings record of a parent, the child does not have to meet the earnings criteria to qualify for benefits.

Learn more about benefits for dependents

To learn more about SSD benefits payable to dependents in 2021 and 2022, speak with a Social Security disability lawyer at the Clauson Law Firm. From initial applications through an appeal of an adverse determination, our SSD lawyer helps you get the benefits you deserve. Contact us today for a free consultation.

FAQ’s Social Security Disability Benefits Pay Chart

Does SSI pay benefits to dependents?

The SSI does not pay benefits to dependents. However, it provides monthly payments for what the SSA defines as an “essential person”, that is, someone who is residing with and providing essential care to the SSI recipient.

How can I earn work credits for SSDI?

You earn work credits based on the income you earn at a job or through self-employment out of which Socia Security taxes are paid.

2 Comments

My question is, my husband is on disability and I was told that my son is the other person that would receive his disability. My son got 794 a month and I didn’t receive any from his disability. My child has graduated high school and his check stop. How canI see if I am entitled to he benifts I wasn’t payed for the 18 years???

I was a dependent on my mom’s ss but never received funds even though I had a few automatic qualified conditions, when I was 21 they found tumor in my heart had to have open heart. I was eligible but didn’t know to reapply, even when it killed my body and mental status to try pushing through illnesses, but I found out in 2012 I couldn’t work anymore, I didn’t know I was completely eligible with 23 work credits at 24 which they’re missing my 4 for 2008 so I’d have 28 credits, so not knowing I qualify my health has just gotten worse to point of life quality is 0 and expectancy is 2 years of I’m lucky, but I need to be able to support myself and my daughter,