What Is Full Retirement Age For Social Security Disability?

Did you know that you can receive Social Security disability after age 65? If that seems wrong based on friends telling you that disability benefits end at retirement age, then you came to the right place. Some of the things you hear or read about disability benefits are either not true or offer a small part of the story.

“Retirement age” for purposes of benefits payable through the Social Security Administration means full retirement age, which may or may not be age 65. Your full retirement age, which is the age when you may begin receiving Social Security retirement benefits, is determined by the year of your birth.

If you receive disability benefits and heard the monthly payments stop when you reach full retirement age, don’t worry. You will continue receiving benefits, but they convert from SSD to retirement benefits.

The more that you know about full retirement age, disability benefits, and something called “early retirement” – yes, there is such a thing – the easier it will be for you to work with your disability lawyer to manage the benefits that you receive. As you continue reading, do not hesitate to rely on the team of disability professionals at the Clauson Law Firm for assistance to apply for benefits, appealing an adverse decision, or manage the benefits that you already receive.

What Is Full Retirement Age?

When President Franklin D. Roosevelt signed the Social Security Act in 1935, workers could qualify for retirement benefits at age 65. The Social Security Disability Insurance program, which was not part of the original Social Security Act, was added through amendments to the law in 1954.

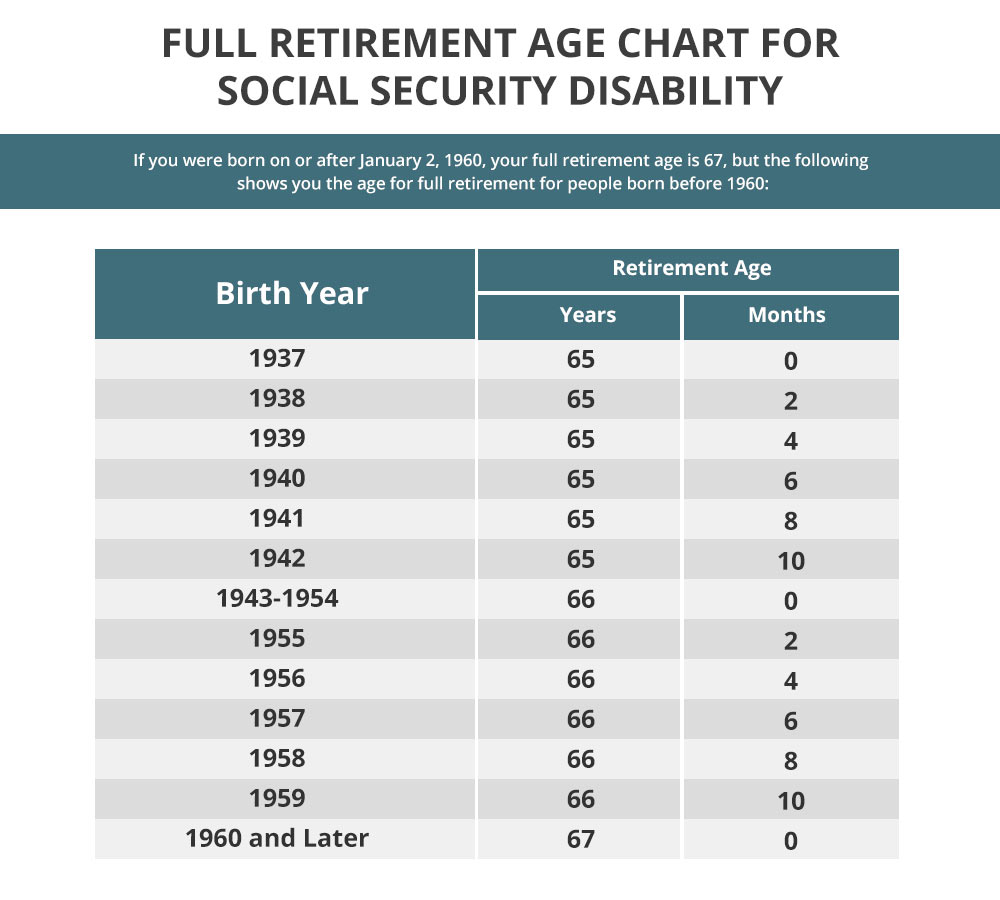

Congress made changes to the law over the years, including raising the age when workers became eligible for retirement benefits, which is the full retirement age or normal retirement age. An amendment to the Social Security Act in 1983 changed the normal retirement age from age 65 using gradual increases based on the year of a worker’s birth.

Below is the full retirement age chart based on the 1983 change to the law:

Someone born on New Year’s Day uses the prior year to determine their normal or full retirement age. For example, if your date of birth is January 1, 1960, your are eligible for full retirement benefits at age 66 years and 10 months because you use 1959 and not 1960.

The fact that you are eligible for retirement benefits does not mean that you must immediately take them. You have the option to delay retirement beyond your full retirement age, which actually increases your benefit payment when you eventually begin receiving retirement benefits.

For example, assume that you continue to work beyond your normal retirement age of 67. Your benefit amount increases each year by 8% through age 69. Delaying retirement in this way does not affect eligibility for Medicare benefits. You become eligible for Medicare at age 65 independent of your retirement status.

Social Security Disability Insurance and Full Retirement Age

Social Security Disability Insurance is a benefit program funded through the Social Security trust fund that relies on payroll taxes. In order to qualify for SSDI, you must have a work record of a long enough duration at jobs or through self-employment where payroll taxes were paid on the income you earned.

If you meet the work requirement for SSDI eligibility, you also must be disabled according to the standard used by the Social Security Administration. You must have a medically determinable physical or mental health impairment that has lasted or is expected to last for at least 12 months or be expected to cause your death. The impairment or impairments must be severe and prevent you from engaging in substantial gainful activity. Only if you meet this definition will Social Security determine that you have a qualifying disability.

Meeting the medical and non-medical requirements to qualify for SSDI is not easy. Fewer than one-third of the applications submitted each year are approved. If you do not receive approval during the initial disability determination process, do not give up. Instead, talk to a disability lawyer at Clauson Lawv about appealing the adverse decision to get the disability benefits that you deserve based on your medical condition and work record.

When you qualify for SSDI benefits, the monthly payment that you receive is typically equivalent to what you would get by retiring at full retirement age based on your lifetime earnings record. If you receive workers’ compensation or other public disability payments, they may reduce your monthly benefit through the SSDI program.

Public disability payments include the following:

- Civil service disability payments

- State temporary disability benefits

- Other state or local retirement benefits paid because you are disabled

The total that you receive each month from SSDI and other public disability payments cannot exceed 80% of the average earnings you had prior to being disabled. A disability lawyer can review your claim to determine how other payments you receive may affect it.

When you reach full retirement age, your SSDI payments end. You cannot receive SSDI and Social Security retirement on the same account, so your SSDI payments automatically convert to retirement benefits when you reach full retirement age.

You should not experience any decrease in the amount you receive each month when you reach full retirement age for SSD, but you may actually see an increase in the monthly payment. The reason is that deductions for workers’ compensation and public disability payments that may have reduced your SSDI payment each month do not apply to retirement benefits.

The conversion from SSDI is automatic. There is nothing that you have to do to make it happen. It’s all handled by the Social Security Administration.

Supplemental Security Income and Full Retirement Age

The fact that you cannot receive both Social Security disability benefits and retirement benefits at the same time is only true when the disability benefits are paid through the SSDI program. If you are among the more than 1.8 million people who qualify for disability benefits through SSI and SSDI, your SSI benefits may continue after you reach full retirement age.

The SSI program pays benefits to adults and children who are blind or disabled and to adults who are age 65 and older without a disability or blindness. It is a need-based program without a work requirement, but you must have very limited income and assets that you own may not exceed $2000 for an individual. Adults must meet the same disability standard to qualify for benefits as the one used for the SSDI program.

As long as the monthly payment you received from SSDI does not exceed the income limits for SSI eligibility, you may qualify for disability benefits through both programs. However, your SSDI benefit will reduce what you get from the monthly SSI benefit for 2023 of $914 for an individual.

If you receive disability benefits through SSI, they will continue unchanged even after you reach full retirement age. One reason for this is that SSI benefits are paid through the general tax revenues of the federal government and not from the Social Security trust fund.

What Is Early Retirement?

Retirement benefits through Social Security are available to you at age 62. Before you jump at the chance to start collecting retirement benefits before full retirement age, there are a couple of things you need to know:

- You do not get the same monthly benefit by retiring early as you would receive by waiting until normal retirement age or later. A person who reaches age 62 in 2023 and elects to take early retirement gets a 30% lower benefit payment than the would get at normal retirement age.

- When you wait until full retirement age to collect benefits, you can continue working without it affecting your monthly benefits. There is a limit on how much money you can earn from working while collecting early retirement benefits. In 2023, you lose $1 in benefits for every $2 you have in work earnings that exceed $21,240 for the year. The year that you reach full retirement age, the earnings limit increases to $56,520 with a $1 benefit reduction for every $3 earned in excess of the annual limit.

- If you become disabled after applying for and collecting early retirement benefits, you can apply for SSDI. However, the early-retirement reduction remains in place.

If you apply for early retirement and subsequently or simultaneously apply for SSDI, you may be eligible for up to 12 months of the difference between what you got through early retirement and the full disability benefit amount. This only occurs when Social Security determines that your disability onset date was before you began receiving retirement benefits. The best thing to do is seek advice and guidance from a disability lawyer before filing for early retirement.

Get Help by Contacting a Skilled Disability Lawyer

Determining how the full retirement age for disability may affect your claim for benefits can be tricky, but a disability lawyer at the Clauson Law Firm can help with it and other issues related to disability applications and appeals. Contact us for a free consultation and claim evaluation.