Pros and Cons of Social Security Disability Insurance

If a physical or mental disability renders you unable to work, you may end up facing severe financial insecurity along with physical or mental trauma. In such a case, the Social Security Disability Insurance (SSDI) program administered by the Social Security Administration (SSA) may offer some much-needed financial relief.

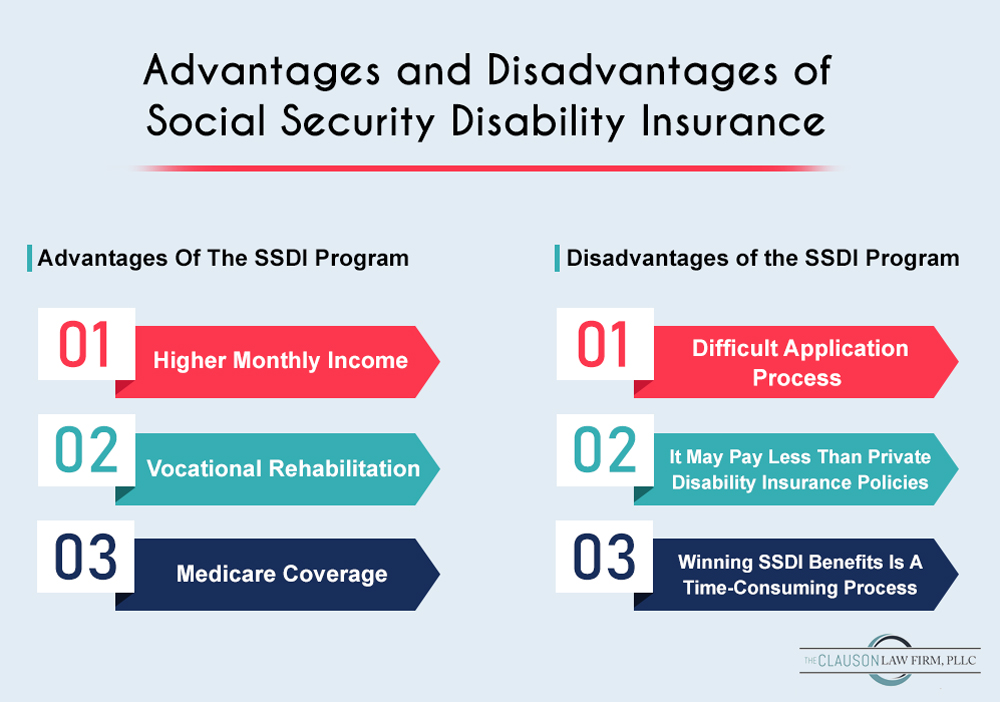

However, winning SSDI benefits may not be as simple. Even though it does offer many advantages, there are many drawbacks associated with the federal insurance program. As such, Social Security Disability Insurance has the following advantages and disadvantages.

What Is The Social Security Disability Insurance Program

The SSDI is a payroll-tax-funded federal insurance program administered by the Social Security Administration. It is designed to provide monthly disability benefits to people who suffer from a medically determinable physical or mental disability that renders the applicant unable to work at a job or through self-employment.

You can trust an experienced SSDI benefits lawyer at Clauson Law with providing quality representation to help you navigate through the complicated SSDI application process.

How To Qualify For The Social Security Disability Insurance Program

SSDI pays monthly cash benefits to workers who are unable to work and earn a living for themselves due to a physical or mental disability. The program is administered by the Social Security Administration and is funded by the Social Security taxes that you pay on your earnings.

To qualify for Social Security benefits, you must meet the following two conditions:

- You must have worked long enough at a job or through self-employment and paid sufficient Social Security taxes to qualify for SSDI benefits.

- You must be unable to engage in substantially gainful employment because of a physical or mental impairment (s) that has lasted for at least 12 months or is expected to last for at least 12 months or result in death.

The money payable as SSDI monthly benefits depends on your past work history, your earnings, and the amount of Social Security taxes that you have paid. A compassionate and experienced SSDI benefits lawyer at Clauson Law understands the medical documentation that you need to provide to win the benefits that you need and deserve. We can help you navigate through the complex application process for getting SSDI benefits.

Advantages Of The SSDI Program

SSDI benefits may offer much-needed financial relief if you are struggling to earn a living due to a physical or mental impairment(s). As such, the federal program administered by the SSA offers three major advantages-

Higher Monthly Income

If you have sufficient work credits and are therefore qualified to receive SSDI benefits, the amount you are entitled to receive in benefits is adjusted according to changes in the cost-of-living adjustments (COLA). In the case of long-term disability benefits, disability pension from your employer, or insurance cover benefits, the monthly benefit payments are not adjusted to revisions in the cost-of-living adjustments.

Therefore, if you are receiving SSDI benefits, you can be assured about upward revisions in your monthly check if the Consumer Price Index rises by a particular percentage. Long-term disability insurance policies do not offer adjusted benefits, even if there is a remarkable rise in inflation levels.

Vocational Rehabilitation

When the Social Security Administration (SSA) approves a Social Security Disability (SSD) benefits application, it is assessed if there are chances of improvement in the applicant’s medical condition. If the individual’s condition improves when taking part in a vocational rehabilitation program and the applicant is now able to support himself/ herself, the SSDI benefits awarded by the SSA will continue till the time the vocational rehabilitation program ends.

If there is no improvement likely, the applicant will be asked to work on a trial period basis. There will be no restriction on your earnings for 9 months. When this period has been reached, a grace period of 3 months will be given during which the applicant can keep working while the case is assessed. If the assessment results in the applicant still being disabled, he/ she can still receive an SSD monthly check, if there is any month over the next three years when the applicant earns less than $1,260 at work.

Medicare Coverage

Getting financial aid is not easy if you are disabled. Employers generally offer only the Consolidated Omnibus Budget Reconciliation Act (COBRA) protection for employees getting disabled at work. COBRA allows employees 18 months of health coverage when they exit a company. However, if a person is eligible for SSD benefits for the first 18 months of COBRA cover, an extra 11 months of COBRA protection can be purchased. This effectively implies that winning SSD benefits can provide you with health coverage of up to 29 months after getting disabled. When COBRA coverage eventually runs out, then a disabled person of any age is eligible for Medicare.

Medicare has two parts. While Part A covers hospital benefits, Part B includes medical benefits.

Disadvantages of the SSDI Program

If you are earning enough at a job or through self-employment and paying Social Security taxes, you may think that you do not need private disability insurance coverage. However, SSDI benefits may be difficult to win and may not cover all your financial needs. Therefore, you should consider getting private disability insurance coverage even if you believe that you are eligible for SSDI benefits. SSDI benefits may go against you because of the following disadvantages:

Difficult Application Process

The complex federal regulations and complicated disability benefits application process make winning SSDI benefits overly difficult.

The average wait time for SSDI applicants to get an eligibility hearing is 360 days. Moreover, only less than one-third of all applications made to the SSA get approved. You may even have to hire a disability benefits lawyer to help win the benefits you need and deserve or appeal a notice of denial.

If your application is not approved the first time you apply, you may have to go through a complicated, four-level appeal process to win the benefits you deserve.

Moreover, the definition of disability used by the SSA for SSDI benefits is notoriously strict. Private long-term disability insurance policies generally have own-occupation definitions, which allow you to qualify for benefits if you cannot do your current job even though you could do some other work. In the case of SSDI, you must prove that you are completely unable to engage in substantial gainful activity to qualify for benefits. SSDI is therefore more stringent than private disability insurance policies.

Apart from proving your disability, you will also have to show that you meet the non-medical requirements to qualify for SSDI benefits.

It May Pay Less Than Private Disability Insurance Policies

Monthly SSDI benefit payments may not cover all your living costs. The average monthly benefits stand at $1,171. Even if you maximize your monthly Social Security contributions, you will get maximum monthly benefit payments of $2,687. On top of it, your monthly SSDI benefit payments may also get taxed, especially if you have an earning spouse.

On the other hand, a private disability insurance policy may offer up to 60 percent of the gross pay before you got disabled and the benefits will also be tax-free if you were paying for your own policy. Moreover, there is greater flexibility when it comes to choosing a private disability insurance policy as per your lifestyle and monthly budget.

SSDI benefits therefore may not cover all your financial needs. Even if you navigate through the complicated SSD application process, you may not gain much out of qualifying for SSDI benefits.

Winning SSDI Benefits Is A Time-Consuming Process

Even if you meet the eligibility criteria prescribed for Social Security Disability Insurance benefits and are also able to prove that you qualify for monthly benefits, you may have to wait for several months before winning the benefits.

There is a huge backlog of disability benefits cases in the United States with over a million people still on the waitlist to have their applications processed by the SSA. Therefore, if you got disabled and applied for SSDI benefits, you may end up waiting for several months before your application is processed. Every year, thousands of SSDI applicants pass away even before receiving a decision on their SSDI application.

If you do not have a private disability insurance policy and you get disabled, there is a high chance that you remain without any income for several months. SSDI therefore may not be a reliable insurance policy to compensate for the lost income after getting disabled.

Contact Clauson Law Today For A Free Consultation And Claim Review

If you or a loved one is unable to work because of a physical or mental impairment, you must contact an experienced and knowledgeable SSD lawyer to understand if you are eligible to win SSDI benefits. An experienced SSDI benefits lawyer at Clauson Law is dedicated to helping you win the benefits you deserve and can help you understand the SSDI program in greater depth. Contact us today for a free consultation and claim review.

4 Comments

Thanks for sharing this amazing post with us. very much informative and really helpful for many injured people.

I like that you mentioned how SSDI benefits may offer much-needed financial relief if you are struggling to earn a living due to physical or mental impairments. I was chatting with some of my friends earlier and I heard that he is planning to file for an SSDI claim. I think he should hire a social security attorney in order to make things easier.

Thanks for helping me understand how hiring a lawyer makes it easier to apply for social security disability insurance. I first heard about this in a novel that I binge-read last weekend. I will consider the idea of consulting these professionals if I need them someday.

I’m currently 62 and receiving $2,100.00 per month in SSDI. I want to return to work earning 5 to 8k per month. I know my SSDI benefits will stop, but will it be to my advantage $$ wise to again start collecting SS Retirement at age 67? My 1st SSDI check was received in June of 2020. Thanks, I’m trying to get back on a Retirement plan + SS Retirement at FRA.