How to Apply and Qualify for Disability Benefits In NC

If you live in North Carolina and have a disability preventing you from working, the lack of steady income and resulting financial hardship becomes an added burden. Fortunately, financial assistance is available through Social Security Disability Insurance and Supplemental Security Income, the two disability programs administered by the Social Security Administration.

Before you apply for disability benefits through SSDI or SSI, know that the process to get the assistance you need and deserve is a complicated one. Each year, more than two-thirds of the folks who file disability claims receive denial letters. Many of them eventually prevail by going through a lengthy appeal process.

At the Clauson Law Firm, we understand how difficult and frustrating it can be to apply for disability benefits only to have the claim rejected because of inadequate medical proof supporting it or a mistake made on the application. This blog post explains the disability programs available to North Carolina residents. It takes you through the application process to improve your chances of getting the help you need and deserve when a disability keeps you from working.

What Is SSDI, And What Does It Take To Qualify For Benefits?

SSDI pays benefits to you and certain members of your family if you have a disability and worked for a long enough duration to meet the non-medical requirements of the program. To be “insured” and eligible for SSDI, you must have paid Social Security taxes on earnings from work or the income derived from self-employment.

In addition to the work history requirement, some of your work years must be recent. You must work and pay Social Security taxes for at least five out of the last ten years before becoming disabled to meet the non-medical requirements to qualify for SSDI. If you meet them, then Social Security turns your application over to the Disability Determination Services to review and decide if you have a disability that meets the standard the SSA must use when evaluating disability claims.

According to the definition of disability federal regulations require SSA to use, a disability requires proof that meets all of the following requirements:

- Have a medically determinable physical or mental impairment.

- The impairment or a combination of impairments must prevent you from doing substantial gainful activity.

- The impairments have lasted or are expected to last for at least 12 months or result in your death.

Substantial gainful activity is the level of physical and mental activities a person must be able to do in a work setting where you’re paid for your efforts. The ability to do household chores, personal hygiene, and participate in social activities is not included as substantial gainful activity.

Social Security evaluates activities as substantial and gainful through the money you earn from doing them. Therefore, you are engaging in substantial gainful activity if your monthly work earnings are $1,470 or more. The monthly earnings for someone disabled due to blindness are $2,460. These earnings figures are for 2023, but they increase in 2024 to $2,490 for someone who is blind and $1,550 for someone with a disability other than blindness.

The monthly SSDI benefit depends on your average lifetime earnings. In 2023, the average SSDI benefit is $1,486 per month, but how much you receive depends on your total Social Security earnings while working. SSDI payments in 2024 will increase because of a 3.2% cost-of-living allowance. Your spouse, former spouse, and your children may be eligible for benefits under your SSDI account,

If you qualify for SSDI benefits, you become eligible for Medicare Part A coverage two years after becoming eligible for disability benefits. The 24-month waiting period is waived for people diagnosed with amyotrophic lateral sclerosis, known as ALS, or end-stage renal disease.

What is SSI?

SSI is a program designed to provide money to cover essential items like food, shelter, and other necessities based on financial need. It is a needs-based program for disabled or blind adults or children and people aged 65 or older with limited incomes and financial resources. The limits on income and resources are very low. For example, an applicant for SSI cannot have resources with a total value above $2,000. The resource limit for couples is $3,000.

The SSA considers income from all sources when determining if a person is eligible for SSI, including the following:

- Wages

- Pensions

- Support payments

- Gifts

However, allowable exclusions may reduce the income that you have available to you for purposes of SSI eligibility.

For example, you may exclude the first $20 from the monthly income you receive from any source. You also may exclude the first $65 of earned income and use the $20 exclusion as long as it was not already used on other income. Of the remaining balance of earned income for the month, only one-half counts in determining eligibility for SSI.

A similar situation arises with resource limits. Cash on hand, bank accounts, stocks, and other assets you own count toward the resource limits, but some assets could be excluded. For example, a motor vehicle is a countable resource, but it does not count if you or someone in your household uses it as transportation. Another example is ownership of a home.

If you own a home and use it as a primary residence, it does not count as a resource. However, if you stop living in the house, SSI counts its value toward the resource limits. A consultation with a disability lawyer at Clauson Law can determine how your income and resources will affect your eligibility for the SSI program.

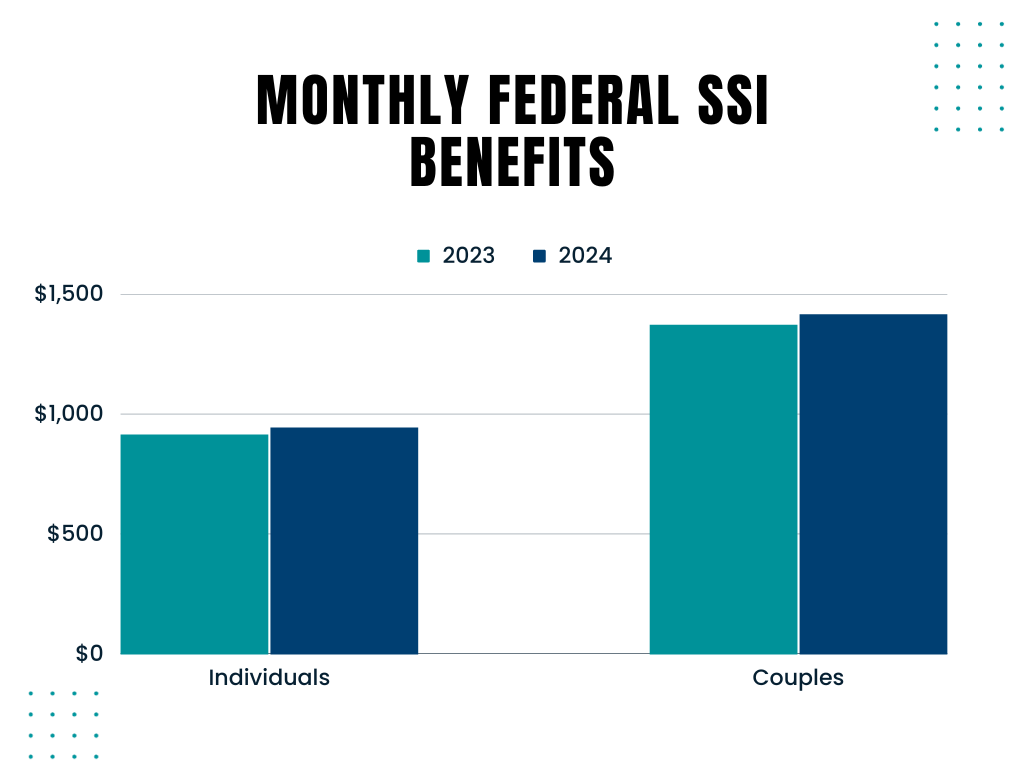

The maximum federal SSI benefit in 2023 is $914 for individuals and $1,371 for couples. The monthly federal SSI benefits will increase in 2024 to $943 for individuals and $1,415 for couples.

North Carolina is one of many states that supplement the federal SSI benefit with a payment from the state. However, only SSI beneficiaries residing in adult care facilities, group homes, and family care facilities are eligible for supplemental payments. A Clauson Law disability lawyer can provide additional information about the North Carolina State-County Special Assistance program.

SSI beneficiaries in North Carolina automatically qualify for Medicaid. The start of Medicaid coverage coincides with your eligibility date for SSI.

How to Apply for SSDI or SSI in North Carolina

There are several ways to apply for SSDI and SSI in North Carolina. You can call Social Security at 1-800-772-1213 Monday through Friday. If you prefer the personal touch, use the same name to schedule an in-person appointment at a local Social Security office. They may allow walk-ins, but you’ll avoid the wait by making an appointment to apply for benefits.

If you’re applying only for the SSDI program, you may apply online for benefits at the Social Security website. SSI and SSDI applications can be submitted through the mail. Get an application form online or by calling 1-800-772-1213.

Application Review Process of Disability Benefits

Upon receipt of your application for disability benefits, Social Security reviews it to verify that you meet the non-medical eligibility requirements for either or both disability programs. If you do, the application goes to the Disability Determination Services, where the information you provided in the application and the medical evidence supporting the claim are reviewed by an examiner.

At the DDS, an examiner may seek additional medical information from you or your health care providers. Examiners ask you to attend a consultative examination by a medical professional treating you or from an independent doctor.

Upon completion of the evaluation of your application, the DDS decides whether you qualify for disability benefits. If you qualify, you’ll receive a letter explaining your benefits and the initial payment date.

You’ll also get a letter when a claim is denied. The denial letter explains the reason for the determination and informs you of your right to challenge it through the appeal process.

The Appeal Process In North Carolina

The following are the four appeals process levels:

- Reconsideration: A new examiner who did not take part in the initial decision reviews your claim. You have 60 days from the denial letter to request reconsideration.

- Hearing: A hearing before an administrative law judge who listens to your testimony and reviews evidence supporting your claim. You have 60 days from receiving the reconsideration decision to request a hearing.

- Appeals Council: The Appeals Council can grant, deny, or dismiss your request for review. You must request a review by the Appeals Council within 60 days of receiving the hearing decision.

- Federal Court: A disability lawyer files a lawsuit on your behalf against Social Security in a federal district court. The lawyer files a lawsuit within 60 days of receipt of the Appeals Council decision.

If you have doubts about pursuing your claim for disability benefits after a denial, consider that 72% of people whose claims were denied at the initial determination stage ended up receiving benefits through the appeal process.

Learn How Legal Representation Can Improve The Outcome Of Your Disability Claim

According to the U.S. Government Accountability Office, its review of outcomes when people file disability claims reveals that claimants who had representation had an approval rate three times higher than those who did not. Learn more about how a disability lawyer at the Clauson Law Firm can make a difference for you. Contact us today for a free consultation.