What Are the Consequences for Misusing Social Security or SSI Funds?

Social Security Disability Insurance (SSDI or SSD) and Supplemental Security Income (SSI) are two essential government programs that provide financial assistance to individuals with disabilities. SSDI is reserved for qualifying workers and former workers who become disabled by illness or injury. Unlike SSDI, SSI is a needs-based program providing benefits to disabled people with low incomes and very limited available resources.

While these programs offer a vital safety net, there are strict rules and regulations governing how funds may be used and what information benefit recipients is obliged to report to the Social Security Administration (SSA). Benefit recipients who violate the rules could face penalties for misuse of the funds resulting in serious consequences.

The Clauson Law Firm has been helping disabled people win approval of disability benefits and advocating on their behalf if they are notified of a decision by SSA to suspend or discontinue those benefits. People depend on SSD and SSI benefits to pay their daily living expenses and there is often very little to spare. Any interruption of benefits can lead to disastrous financial circumstances for the disabled person and their family.

If you have a question about misuse of Social Security benefits or you need help dealing with a notice of suspension, contact the Clauson Law Firm. We have decades of expertise in disability law and our highly trained and committed staff will be eager to give you the guidance you need.

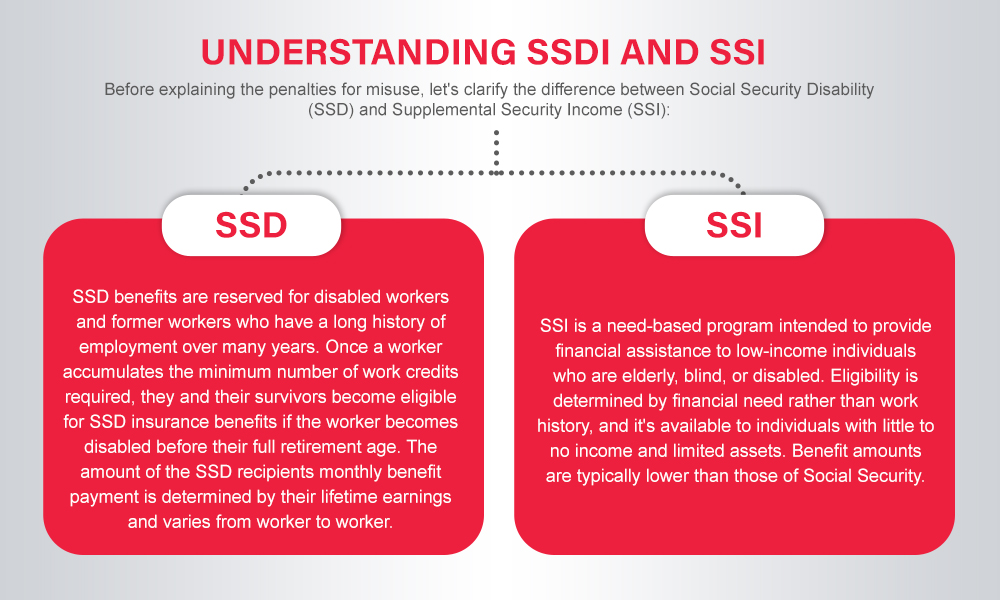

Understanding SSD and SSI

Before explaining the penalties for misuse, let’s clarify the difference between Social Security Disability (SSD) and Supplemental Security Income (SSI):

- SSD benefits are reserved for disabled workers and former workers who have a long history of employment over many years. Once a worker accumulates the minimum number of work credits required, they and their survivors become eligible for SSD insurance benefits if the worker becomes disabled before their full retirement age. The amount of the SSD recipient’s monthly benefit payment is determined by their lifetime earnings and varies from worker to worker.

- SSI is a need-based program intended to provide financial assistance to low-income individuals who are elderly, blind, or disabled. Eligibility is determined by financial need rather than work history, and it’s available to individuals with little to no income and limited assets. Benefit amounts are typically lower than those of Social Security.

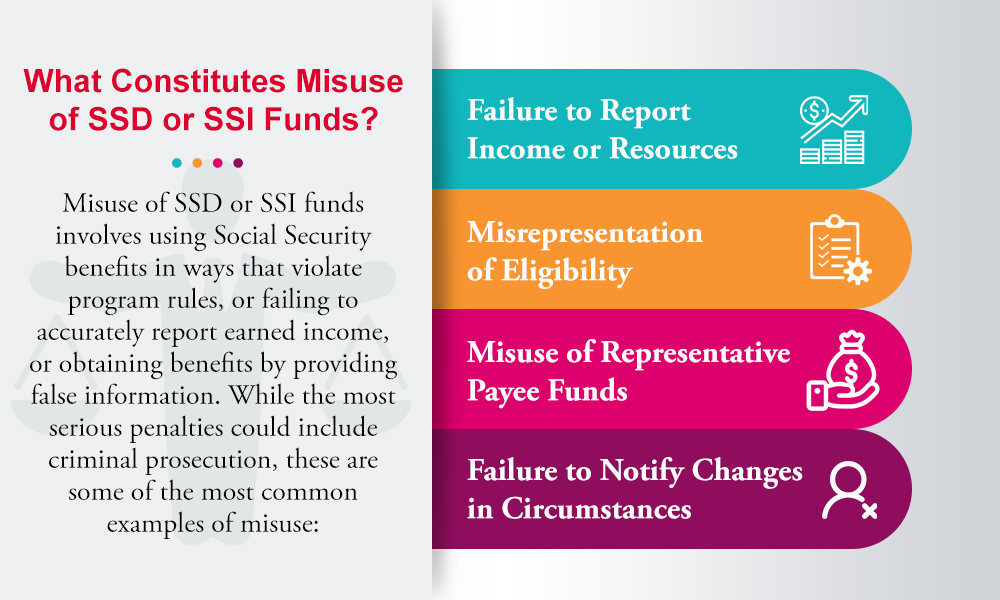

What Constitutes Misuse of SSD or SSI Funds?

Misuse of SSD or SSI funds involves using Social Security benefits in ways that violate program rules, or failing to accurately report earned income, or obtaining benefits by providing false information. While the most serious penalties could include criminal prosecution, these are some of the most common examples of misuse:

Failure to Report Income or Resources:

Recipients are required to report any earned income they receive beyond their monthly benefits. SSD recipients may collect unearned income, which is not counted for purposes of SSD benefits. SSD benefits do not measure or restrict available financial resources. SSI does restrict them.

However, SSI benefit recipients are obliged to report any unearned income used for either shelter or food. Failure to do so can result in overpayments, which must be repaid. And SSI recipients must also report any financial resources they come into possession of that may exceed the SSI eligibility cap.

Misrepresentation of Eligibility:

Providing false information or misrepresenting one’s eligibility for SSD or SSI benefits is considered misuse. This can include not disclosing income or assets that would affect eligibility.

Misuse of Representative Payee Funds:

If a disability benefits recipient is incompetent or otherwise unable to manage their own financial matters, the Social Security Administration allows the beneficiary to appoint a representative payee to receive and distribute the benefit funds as is appropriate for the welfare of the true recipient. In cases where a representative payee is appointed to manage benefits on behalf of a beneficiary, using those funds for personal gain or failing to use them for the beneficiary’s needs constitutes a serious misuse.

A representative payee is a fiduciary who is obliged to use the funds for the recipient’s benefit. While some nominal administrative fee is allowed, in no case is more than 10% of the monthly benefit amount.

Failure to Notify Changes in Circumstances:

Recipients are required to report any changes in their circumstances that might affect their eligibility or benefit amount. This includes changes in income, living arrangements, and marital status.

Penalties for Misuse of Social Security or SSI Funds

The penalties for misuse of SSD or SSI funds can be severe and will depend on the nature of the misuse, the amount of money misused, and the person’s previous record of misusing such funds, if any.

Overpayment and Repayment:

When the Social Security Administration (SSA) identifies misuse or overpayment, the recipient is required to repay the excess benefits received. In most cases, obtaining repayment from the recipient would be difficult since the person may not have the funds on hand. Instead, the SSA will reduce or suspend the recipient’s ongoing and future payments until the sum withheld is equal to the value of the benefits overpaid.

Criminal Charges:

In cases of intentional fraud or misuse, criminal charges can be filed against the individual responsible. This can result in fines, probation, or imprisonment, depending on the severity of the offense.

The type of fraud that would almost certainly lead to criminal charges does not include accidental or unintentional errors made on income reports or other similar documents. The criminal fraud targeted by the SSA and the Department of Justice is the intentional schemes perpetrated by someone who is clearly ineligible and who falsifies their medical records, uses a false identification, or who files multiple disability claims under false names to receive multiple benefit payments per month.

The criminal penalties for a Social Security fraud conviction, intentionally making a materially false statement to obtain Social Security benefits, includes up to 5 years in federal prison and a $25,000 fine per count. The court will also require payment of restitution to the SSA.

Loss of Benefits:

Misuse may lead to the suspension or termination of SSD or SSI benefits. Recipients may be disqualified from receiving future benefits for a specified period. This disqualification is different from the withholding of benefits to repay an overpayment. Punitive disqualification is imposed when there is evidence of intentional falsehood or knowing receipt of benefits for which the person is ineligible.

The periods of punitive disqualification are as follows:

- Six consecutive months the first time we penalize you;

- Twelve consecutive months the second time we penalize you; and

- Twenty-four consecutive months the third or subsequent time we penalize you.

Probation and Supervision:

As part of a criminal sentence, individuals may be placed on probation or supervised release, requiring them to comply with specific conditions set by the court.

Permanent Loss of Eligibility:

Individuals convicted of certain offenses may lose their eligibility for SSD or SSI benefits permanently.

It’s important to note that the penalties for misuse can vary depending on the specific circumstances of each case and whether the misuse was intentional or due to negligence.

Protecting Yourself from Misuse Allegations

If you are a recipient of Social Security Disability (SSD or SSDI) or Supplemental Security Income (SSI) benefits, it’s essential to protect yourself from allegations of misuse.

The Social Security Administration and/or any law enforcement agency investigating SSD or SSI misuse will need to identify and present evidence of a person’s wrongdoing or unauthorized receipt of benefits before adverse action against the person can be sustained. However, there are things you can do to protect yourself from suspicion or from an unfounded claim that you received benefits to which you were not entitled.

Here are a few valuable tips to help you defeat a charge of misusing disability funds:

- Maintain Accurate Records: Keep records of your income, expenses, and any changes in your circumstances that may affect your eligibility or benefit amount.

- Report Changes Promptly: Notify the SSA promptly of any changes in your income, living arrangements, or marital status.

- Use a Representative Payee Wisely: If you have a representative payee, ensure that they use your benefits for your needs and report any concerns to the SSA. It’s a good idea if you insist on receiving a monthly accounting from your representative payee listing the total amount held in your account, along with an itemized statement of each expenditure.

- Seek Legal Advice: If you are facing allegations of misuse, consult with an experienced Social Security disability attorney experienced in these matters to protect your rights and provide a strong defense.

To avoid misuse allegations and ensure compliance with program rules, recipients should stay informed about their responsibilities, promptly report any changes in their circumstances, and seek legal advice if they face misuse allegations. By doing so, individuals can protect their benefits and avoid the serious consequences associated with misuse of Social Security or SSI funds.

If you have questions or need help because you were notified by the SSA of a benefit reduction, suspension, or termination, contact The Clauson Law Firm today. We’re here to help you.